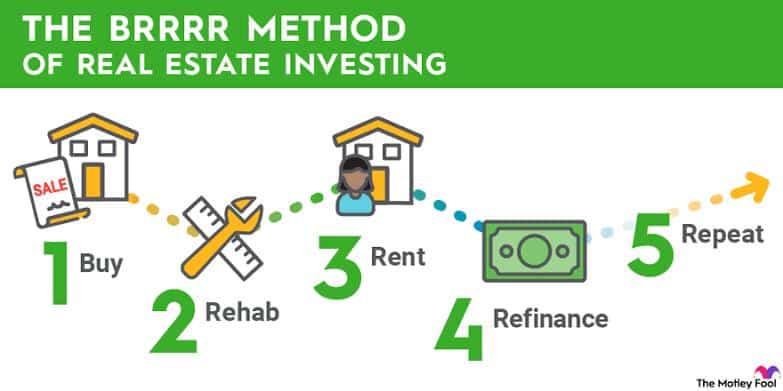

]Discover the 5 steps of the BRRRR method_Buy, Rehab, Rent, Refinance, Repeat—and learn how this powerful real estate investing strategy can help you build long-term wealth.

BRRRR Method Explained: 5 Steps to a Real Estate Investing Strategy for Long-Term Wealth

Are you looking to build long-term wealth through real estate investing? The BRRRR method may be the strategy you’ve been seeking. This powerful approach—Buy, Rehab, Rent, Refinance, Repeat—has helped countless investors grow their portfolios and generate passive income. By following these five carefully orchestrated steps, you can leverage your initial investment to acquire multiple properties over time.

In this article, you’ll discover how to implement this strategy effectively and set yourself on the path to real estate success.

Understanding the BRRRR Method

The BRRRR method is a powerful real estate investing strategy that can help you build long-term wealth through property acquisition and optimization. BRRRR stands for Buy, Rehab, Rent, Refinance, and Repeat. This systematic approach allows investors to leverage their initial capital to acquire multiple properties over time.

The Five Steps of BRRRR

- Buy: Identify and purchase undervalued properties with potential for appreciation.

- Rehab: Renovate the property to increase its value and attract quality tenants.

- Rent: Secure reliable tenants to generate consistent cash flow.

- Refinance: Obtain a cash-out refinance based on the property’s improved value.

- Repeat: Use the funds from refinancing to acquire additional properties.

By following this cycle, you can potentially grow your real estate portfolio exponentially. The BRRRR method capitalizes on forced appreciation through strategic improvements and market-driven value increases.

However, success with the BRRRR method requires careful market analysis, accurate renovation cost estimates, and a solid understanding of local rental markets.

The 5 Steps of the BRRRR Method

The BRRRR method is a powerful real estate investing strategy that can help you build long-term wealth. This approach consists of five key steps: Buy, Rehab, Rent, Refinance, and Repeat. Let’s break down each step to understand how they work together.

Buy

Your first task is to locate and purchase a property below market value. Look for distressed properties or those in need of renovation, as they often offer the best potential for appreciation.

Rehab

Once you’ve acquired the property, it’s time to renovate. Focus on improvements that will increase the property’s value and attract quality tenants. This step is crucial for maximizing your return on investment.

Rent

After the rehab is complete, find reliable tenants to occupy your property. This step provides steady cash flow and helps cover your ongoing expenses.

Refinance

With the property now improved and generating rental income, you can refinance to pull out your initial investment. This step allows you to recover your capital while still maintaining ownership of the asset.

Repeat

Finally, use the funds from your refinance to invest in your next property, repeating the process to grow your real estate portfolio. This cyclical approach allows you to leverage your investments and scale your wealth over time.

By following these five steps diligently, you can create a sustainable strategy for building wealth through real estate investing. The BRRRR method offers a systematic approach to growing your portfolio while minimizing risk and maximizing returns.

Benefits of Implementing the BRRRR Method

Accelerated Wealth Building

The BRRRR method offers a powerful strategy for rapidly expanding your real estate portfolio. By recycling your initial investment through refinancing, you can acquire multiple properties with the same capital base. This approach allows you to leverage your funds more effectively, potentially accelerating your wealth accumulation compared to traditional buy-and-hold strategies.

Improved Cash Flow

One of the key advantages of the BRRRR method is its potential to generate strong cash flow. By purchasing distressed properties at below-market prices and adding value through renovations, you can significantly increase rental income. This improved cash flow not only helps cover your mortgage payments but can also provide a steady stream of passive income.

Tax Benefits

Implementing the BRRRR strategy can offer substantial tax advantages. The rehabilitation phase allows you to deduct renovation expenses, while depreciation on the property provides additional tax benefits. Moreover, by holding properties for the long term, you may benefit from lower capital gains tax rates when you eventually sell.

Risk Mitigation

The BRRRR method inherently includes a built-in safety net. By focusing on properties with strong value-add potential, you create instant equity through renovations. This equity buffer can help protect your investment during market downturns. Additionally, the refinancing step allows you to recoup much of your initial investment, reducing your overall risk exposure.

Real-Life Examples of the BRRRR Method in Action

The Fixer-Upper Transformation

According to Reddit, consider Sarah a savvy investor who purchased a dilapidated property for $100,000 in an up-and-coming neighborhood. She invested $50,000 in renovations, transforming it into a modern, attractive rental. After rehab, the property appraised for $200,000. Sarah refinanced, pulling out $150,000 to repay her initial investment and renovation costs. Now, she collects $1,500 monthly in rent, creating positive cash flow while building equity.

The Multi-Unit Marvel

James, another BRRRR enthusiast, targeted a neglected fourplex priced at $300,000. He spent $100,000 on repairs and upgrades, focusing on energy efficiency and curb appeal. Post-renovation, the property value soared to $550,000. James refinanced, recouping his $400,000 investment. With all units occupied, he now enjoys a steady $4,000 monthly income stream, exemplifying the BRRRR method’s potential for scaling a real estate portfolio.

The Commercial Conversion

Emily showcased the BRRRR strategy’s versatility by acquiring an old warehouse for $500,000. She invested $250,000 to convert it into trendy office spaces. The property’s value skyrocketed to $1.2 million after renovations. Emily refinanced, recovering her $750,000 investment, and now collects substantial rent from multiple business tenants.

This example highlights how the BRRRR method can be applied beyond residential properties, opening doors to lucrative commercial real estate opportunities.

Getting Started with the BRRRR Method in Your Real Estate Investing

Starting your journey with the BRRRR method can be an exciting yet challenging endeavor. To set yourself up for success, it’s crucial to lay a solid foundation before diving in. Here are some key steps to help you get started:

Educate Yourself

Before jumping into your first BRRRR deal, invest time in learning the ins and outs of this strategy. Read books, attend real estate seminars, and join online forums dedicated to BRRRR investing. Understanding the nuances of each step—Buy, Rehab, Rent, Refinance, and Repeat—will help you avoid costly mistakes and maximize your returns.

Build Your Network

Success in real estate often hinges on who you know. Start networking with other investors, contractors, real estate agents, and lenders specializing in BRRRR deals. These connections can provide valuable insights, potential partnerships, and access to off-market properties.

Analyze Your Market

Research your target market thoroughly. Look for areas with strong rental demand, potential for appreciation, and favorable local regulations. Understanding market trends and neighborhood dynamics will help you identify promising investment opportunities and avoid overpriced properties.

Create a Solid Financial Plan

BRRRR investing requires significant capital, especially in the initial stages. Develop a comprehensive financial plan that includes your investment goals, funding sources, and contingency reserves. Consider working with a financial advisor to ensure your BRRRR strategy aligns with your overall wealth-building objectives.

Conclusion

As you embark on your BRRRR method journey, remember that success in real estate investing requires diligence, patience, and a willingness to learn. By following the five steps outlined in this article—Buy, Rehab, Rent, Refinance, and Repeat—you can build a robust portfolio of income-producing properties while maximizing your return on investment.

Stay informed about market trends, maintain strong relationships with lenders and contractors, and always conduct thorough due diligence before making investment decisions.

With careful planning and execution, the BRRRR method can be a powerful strategy for creating long-term wealth and achieving your financial goals in the dynamic world of real estate.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Thank you, your article surprised me, there is such an excellent point of view. Thank you for sharing, I learned a lot.

Thank you, your article surprised me, there is such an excellent point of view. Thank you for sharing, I learned a lot.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.